Gulf Energy, through its affiliate Auron Energy, has signed a sale and purchase agreement with Tullow Oil that will see it acquire 100 per cent of Tullow’s interest in Kenya for a minimum cash consideration of $120 million (Sh15.5 billion).

Tullow and Gulf Energy agreed to the sale in April this year, ushering Gulf Energy into the upstream petroleum sector and taking on the task of pushing Kenya’s fledgling oil industry into being a key economic sector.

Gulf has been active in Kenya’s petroleum sector and is currently the key oil firm in the state brokered Government-to-Government fuel importation deal with Middle Eastern oil companies.

It has in the past been involved in the retail sale of petroleum but sold its network of petrol stations to Rubis in 2019. In a statement on Tuesdat, Tullow Oil said it had signed the sale and purchase agreement with Auron Energy. The Mauritius-incorporated firm recently acquired an 80 per cent stake in Gulf Energy.

The transaction now hinges on key conditions precedent, including approval from the Competition Authority of Kenya and the implementation of a plan to physically and functionally separate Tullow Kenya from the Tullow Group.

Tullow said payment of the said Sh15.5 billion by Gulf has been staggered in three phases in equal tranches of $40 million, with the last payment of $40 million (Sh5.1 billion) expected to be made over five years after 2028, when the Lokichar oil fields are expected to have started commercial oil production.

“The consideration will be split into a $40 million payment due on completion, US$40 million payable at the earlier of Field Development Plan (FDP) approval or 30 June 2026, and $40 million payable over five years from the third quarter of 2028 onwards,” said Tullow in a statement.

“In addition, Tullow will be entitled to royalty payments subject to certain conditions. Tullow also retains a no-cost back-in right for a 30 per cent participation in potential future development phases. This right can be exercised if a third-party investor participates in future development phases, whether through a sale or farm-down of the Purchaser’s interest in the assets.”

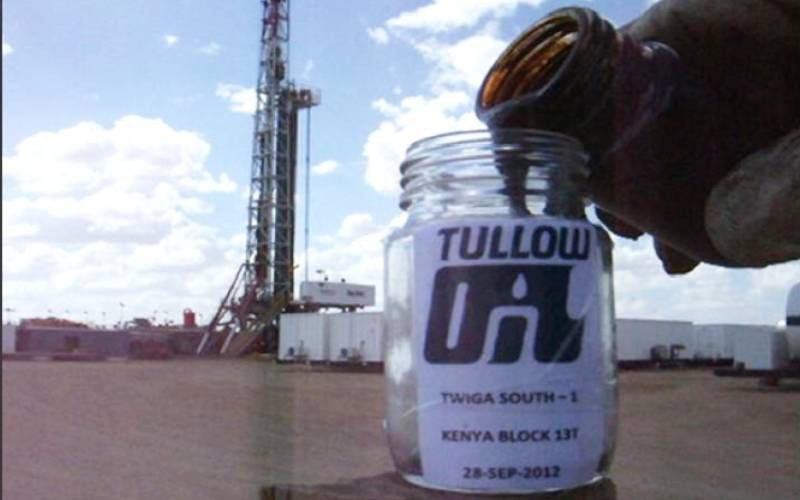

Since Tullow discovered oil in Lokichar, Turkana County, it has over the last decade been trying to move the project to the commercial phase. It has in recent years been looking for strategic investors, but in April this year said it had gotten into an agreement with Gulf to acquire the rights.

The project also faced a setback when French giant TotalEnergies and Canada-based Africa Oil Corp withdrew two years ago, leaving Tullow solely responsible for the significant investment required. Other than the lack of funds and failure to secure a strategic partner, the approval of Tullow’s Field Development Plan (FDP) has faced delays.