Officials managing the Financial Inclusion Fund have dismissed claims of misappropriation, saying no money was withdrawn irregularly from the National Treasury despite audit queries.

The fund, popularly known as the Hustler Fund, was launched on Wednesday, November 30, 2022, to offer affordable financial products to low-income Kenyans.

By the end of June 2023, it had received Sh20.2 billion in capital, with Sh12 billion set aside for lending, Sh8 billion allocated to match long-term savings and Sh200 million provided for operations.

Principal Secretary for Micro, Small and Medium Enterprise Development, Susan Mang’eni, explained that the Sh8 billion had not been accessed because the matching savings product was still under development.

“It would have been imprudent for the fund to draw down the money only to idle in the commercial banks,” Mang’eni noted.

She added that the first match of savings only took place during the fund’s first anniversary on Thursday, November 30, 2023.

Her statement follows an audit finding by Auditor General Nancy Gathungu, who flagged Sh8 billion allocated to the Hustler Fund in the year ending June 2023 as unaccounted for, despite confirmation that the National Treasury had disbursed the amount to the State Department for Cooperatives Development.

In her report, Gathungu noted that the department spent Sh14 billion out of its approved Sh22.96 billion budget, leaving an unspent balance of Sh8.2 billion. This represents 36 per cent of the total allocation.

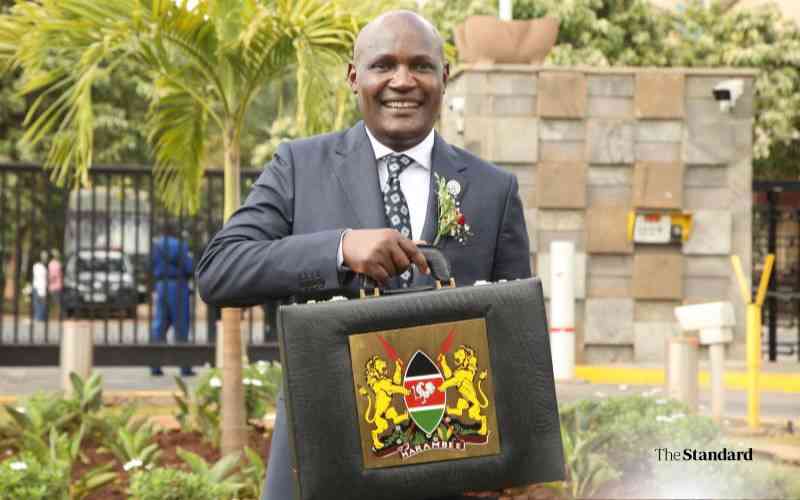

Appearing before the National Assembly Public Accounts Committee, chaired by Butere MP Tindi Mwale, Cooperatives Principal Secretary Patrick Kilemi said the department had requested the release of Sh12 billion for the Hustler Fund. However, no request was made for the remaining Sh8 billion.

“The department made a request for the transfer of Sh12 billion to the Hustler Fund which were processed and transferred,” Kilemi explained.

“But no request was made for processing the balance of the final batch of Sh8 billion, thus an under-absorption,” he added.

Mang’eni confirmed the department will submit all required documents within the two-week window provided by the committee.

Despite the audit concerns, officials maintain the fund is fulfilling its mission. More than Sh71 billion has been disbursed to over 26 million people through personal, group and bridge loans.

Mang’eni said the fund has mobilised about Sh4.8 billion in both voluntary and mandatory savings.

She added that borrowers are now being rated using a behavioural credit system with nine performance bands ranging from A1 to C3.

Stay informed. Subscribe to our newsletter

“More than 4.5 million repeat borrowers are scoring within the A and B bands.That reflects strong credit habits,” she observed.

The bridge loan product, introduced during the fund’s anniversary, is now being converted into a 30-day term facility.

Mang’eni noted this move will help reliable borrowers qualify for higher loan limits while building a formal credit history.

“We remain committed to expanding financial access to Kenyans who have been excluded from credit for too long.The aim is to close market gaps and open doors for those at the bottom of the economic ladder,” she added.